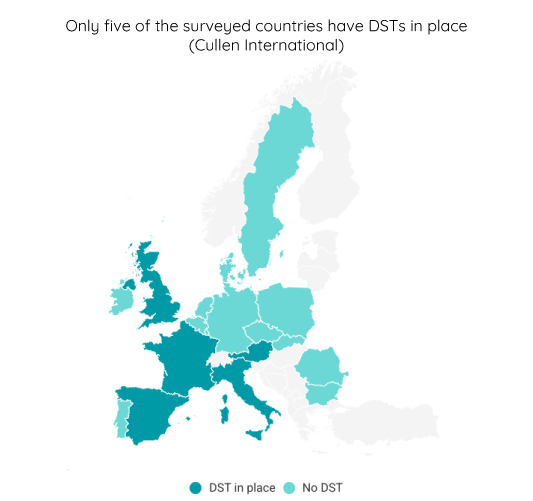

New research by Cullen International shows which among the 19 European countries surveyed have proposed or adopted specific taxes on digital services (DSTs).

As of May 2025, Austria, France, Italy, Spain and the UK have introduced their own national DSTs, following a similar approach to the failed EU DST.

Belgium and Poland are currently discussing the introduction of national DSTs.

In 2018 the European Commission proposed a digital services tax (DST) of 3% of the revenues generated from certain digital services in each EU member state. However, member states failed to agree on the EU DST.

At international level, instead, the Organisation for Economic Cooperation and Development (OECD) global agreement on the reform of the international tax system of October 2021 foresaw the removal of existing DSTs. The multilateral convention implementing the global agreement was expected to be finalised by June 2024. However, negotiations are still ongoing.

For more information and access to the full benchmark, please click on “Access the full content” - or on “Request Access”, in case you are not subscribed to our European Digital Economy service.

more news

29 October 25

To Space and beyond – part II: Regulating and licensing the terrestrial part of satellite systems in the Americas

Our new satellite benchmark on requirements for fixed earth stations licensing in the Americas summarises the key regulatory procedures and identifies the relevant government authorities.

27 October 25

Global trends in cloud regulation

Our latest Global Trends benchmark provides key insights on current practices in each of 14 jurisdictions around the world on: (1) data localization requirements, (2) cross-border personal data transfers, including across specified sectors, and (3) the main rules applicable to data centres and cloud service providers.

24 October 25

How are EU member states transposing NIS2?

Our benchmark tracks the transposition status of the directive on measures for a high common level of cybersecurity across the EU (NIS2) in the 27 member states. 15 countries adopted national legislation to transpose NIS2.