More and more mobile network operators (MNOs) are selling their masts to tower companies, while maintaining ownership of the active equipment.

MNOs can either move towers into a fully owned legally separate company or sell, partially or completely, the passive equipment to tower companies or other stakeholders or funds.

Cullen International’s benchmark analyses the business models adopted in 23 European countries, whether tower companies are registered under the general authorisation regime and if governments adopted specific legislation to stop foreign takeover of tower companies.

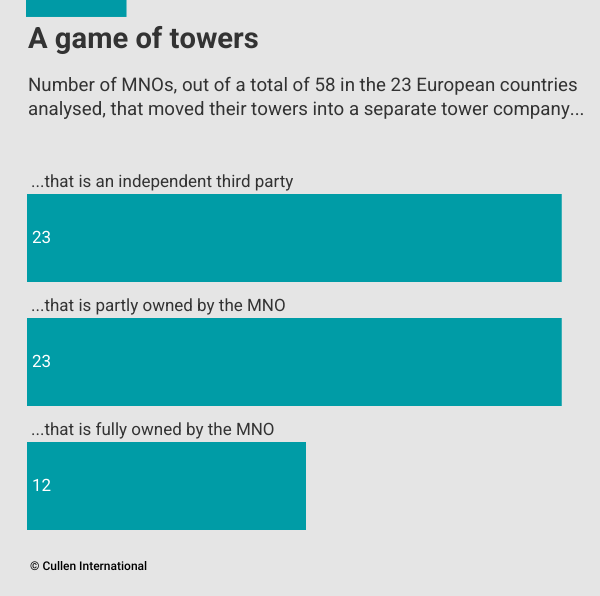

The benchmark found that 46 of the 58 analysed MNOs partially or completely sold their towers.

In many cases, Cellnex bought towers from MNOs. Vantage Towers operates in nine different countries, although not all countries with the presence of Cellnex or Vantage Towers are covered.

In just over half of the analysed countries, tower companies are registered under the general authorisation framework.

No government adopted specific legislation aimed at stopping foreign takeover of towers. However, many countries have general legislation to screen foreign investments in critical sectors.

For more information and access to the full benchmark, please click on “Access the full content” - or on “Request Access”, in case you are not subscribed to our European Telecoms service.

And don't miss our upcoming webinar:

more news

19 December 25

CSRD transposition: Belgium, Denmark, Finland and Slovenia transpose the “stop-the-clock” directive

Cullen International’s updated benchmark tracks the progress made by the 27 EU member states in transposing the CSRD and the related “stop-the-clock” directive.

19 December 25

Global trends in AI regulation

Our latest Global Trends benchmark compares policies and regulations on artificial intelligence (AI) across 14 jurisdictions around the world.

19 December 25

Implementation of European Media Freedom Act: general overview in 12 EU member states

Our new Media benchmark shows if there are initiatives/rules in the selected countries which aim to put into application the EU Media Freedom Act (EMFA). If yes, it describes the scope of the main measures proposed. The benchmark also provides information on the next legislative or regulatory steps.