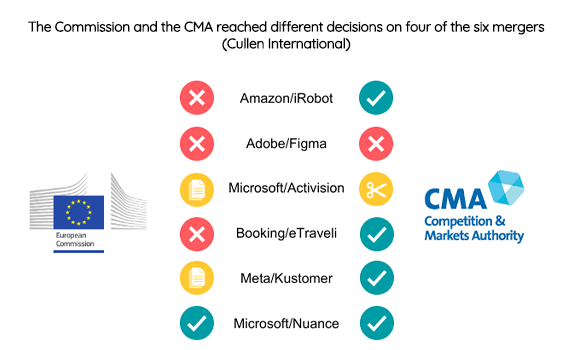

The UK's exit from the EU in 2021 empowered the UK Competition and Markets Authority (CMA) to probe big global mergers concurrently with the European Commission. So far, six acquisitions in digital markets have faced such parallel merger reviews. In five of them, both the acquirer and the target was a US-based company.

Our new report looks at these cases side by side, shedding light on the different conclusions often reached by the two authorities.

Stay tuned over the next weeks, as we look back at each case that saw divergent outcomes. Complimentary copies of detailed case summaries from Cullen International’s Antitrust & Mergers Database are available on request.

Case 4: Meta/Kustomer

The last case of EU-UK divergence we will look at is Meta’s $1bn (€921m) acquisition of Kustomer, a customer relationship management (CRM) software provider.

The transaction did not ring alarm bells at the CMA, mainly due to Kustomer’s limited size in the CRM software market. It received unconditional clearance in the UK following an initial review in September 2021.

In contrast, the Commission’s in depth investigation concluded that the acquisition would harm competition in the CRM software market, where Meta could foreclose Kustomer’s rivals by denying or degrading their access to its messaging channels (Messenger, WhatsApp and Instagram).

The Commission eventually cleared the transaction in January 2022, subject to a set of access commitments by Meta.

These commitments were lifted in November 2023, after Meta spun off Kustomer, retaining only a non-controlling minority stake in the company.

Subscribed clients can directly access our full coverage through the following links:

- Meta/Kustomer merger EU case summary

- Meta/Kustomer merger UK case summary

- Report on parallel merger reviews in the EU and UK

If you are not subscribed to our Antitrust & Mergers service, you can request more information and access through the button below.

more news

08 January 26

Video gaming: EU regulatory and competition law implications across the value chain

Cullen International’s special report published in December 2025 explores the gaming value chain, with a focus on the application of regulation and competition law in the EU.

07 January 26

Average time to resolve a postal complaint in Europe varies from days to years

Our latest benchmark provides information on how end users' complaints are handled in the European postal sector, including operators' own complaint procedures, escalating procedures and statistics.

19 December 25

CSRD transposition: Belgium, Denmark, Finland and Slovenia transpose the “stop-the-clock” directive

Cullen International’s updated benchmark tracks the progress made by the 27 EU member states in transposing the CSRD and the related “stop-the-clock” directive.