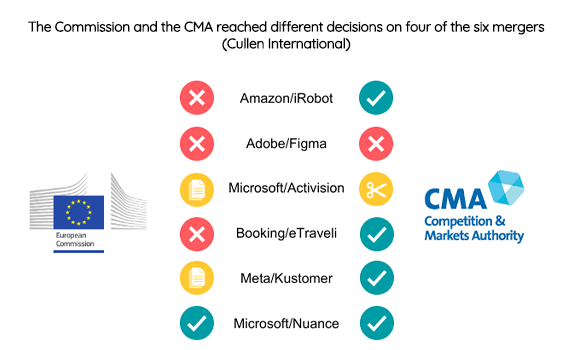

The UK's exit from the EU in 2021 empowered the UK Competition and Markets Authority (CMA) to probe big global mergers concurrently with the European Commission. So far, six acquisitions in digital markets have faced such parallel merger reviews. In five of them, both the acquirer and the target was a US-based company.

Our new report looks at these cases side by side, shedding light on the different conclusions often reached by the two authorities.

Stay tuned over the next weeks, as we look back at each case that saw divergent outcomes. Complimentary copies of detailed case summaries from Cullen International’s Antitrust & Mergers Database are available on request.

Case 3: Booking/eTraveli

The CMA unconditionally cleared Booking’s proposed €1.63bn acquisition of eTraveli in September 2022, but the transaction was blocked by the Commission one year later.

Both Booking and eTraveli operate online travel agencies (OTAs), though they focus on different product markets: Booking mainly provides hotel OTA services, while eTraveli mainly provides flight OTA services.

Despite the lack of major horizontal overlaps, the Commission was concerned that the enlargement of Booking’s “travel services ecosystem” through the acquisition of eTraveli would strengthen the company’s dominant position in the hotel OTA market in the European Economic Area (EEA).

One of the Commission’s key findings was that flight OTAs like eTraveli are an important customer acquisition channel for hotel OTAs in the EEA.

The CMA reached the opposite conclusion. It reckoned that flight OTAs are not a particularly significant customer acquisition channel for hotel OTAs in the UK.

Subscribed clients can directly access our full coverage through the following links:

- Booking/eTraveli EU case summary

- Booking/eTraveli UK case summary

- Report on parallel merger reviews in the EU and UK

If you are not subscribed to our Antitrust & Mergers service, you can request more information and access through the button below.

more news

10 December 25

Recent initiatives to protect copyrighted works from unlicensed use in training AI models in the Americas

Our new benchmark compares new initiatives across the Americas that address the impact of artificial intelligence (AI) training on the creative sector, particularly regarding the use of copyright-protected works.

09 December 25

Initiatives to protect the creative sector from the unlawful exploitation of copyrighted works by AI systems in Europe

Our new European benchmark shows national debates on the impact of artificial intelligence on the creative sector, particularly regarding the use of copyright protected works to train generative AI systems.

01 December 25

Lithuanian regulator plans local regulatory holidays in the wholesale local access market

FREE download for ALL of our latest analysis!